Q1 Fertilizer Review

Urea, DAP and MOP prices were mixed at the close of the 1st quarter but are expected to soften until more demand comes at the start of the seasons in S.E. Asia.

Conflict in the Middle East between Israel and Hamas in the Gaza Strip continues to cause cargo delays and freight increases from the Red Sea.

Lack of sufficient rainfall due to El Niño continues to slow traffic through the Panama Canal although the situation is improving.

Conflict between Ukraine and Russia continues to affect world freight and insurance markets.

China’s decision on 9 November 2023 to halt exports has been lifted for DAP as of 15 March 2024. NPK exports are expected to resume 1 May and Urea exports in June. SOP exports remain restricted.

The Thai Baht / US Dollar exchange rate weakened ending the quarter 35.8 – 36.5 Baht / USD range.

UREA

Urea ended the quarter at $372 CFR, up 4.2% for the quarter and 10% year over year. Local wholesale prices ended the quarter at 14,300 Baht in bulk per metric ton ex-warehouse.

The quarter began with India tendering for 647,000 tons of urea at $329.40 CFR (East Coast) and $316.80 CFR (West Coast). Although lower than the 1.0 – 1.5 million tons expected to be tendered, this sparked a rally in urea sending prices as high as $415 CFR Thailand in February.

After a strong January and February, prices declined in March and have broken through key long-term support on the downside. Offers at the end of the quarter into Thailand were at the $370’s level.

The quarter ended with India issuing another tender on 27 March. 760k tons were purchased in the $339 - $348 per ton CFR range. Local production of urea in India continues to increase (2.49 million tons in March) and 31.3 million tons from April 2023 to March 2024 (up 9.8%). This is reducing the quantity and frequency of Indian urea tenders.

Pertronas’ (Malaysia) Bintulu and Gurun granular Urea plants will come online to begin the 2nd quarter after one month of maintenance.

Urea is expected to weaken into the 2nd quarter.

DAP

DAP prices declined slightly in the 1st quarter to $616 CFR. Year over year, DAP prices have increased 3%. Local wholesale prices traded at around 23,000 Baht per metric ton at the end of the quarter.

China announced on 15 March, exports could resume with a 7-day CIQ inspection. Cargo from China for April and May has mostly been booked. The supply of DAP in Thailand remains tight but should loosen in May and June with fresh cargoes from China.

Traders are shorting DAP tenders for May into India with products from Saudi Arabia, Morocco, and Russia. This, in turn, should drive down Chinese prices. DAP prices have broken through long-term support levels on the downside.

DAP is expected to weaken significantly in the 2nd quarter.

MOP

Granular MOP prices declined 8% in the 1st quarter to around the $335 CFR level and declined 40% year over year. Local wholesale prices ended the quarter at 12,900 – 13,200 Baht per metric ton.

The MOP market was quiet in the first quarter but is expected to pick up with the start of the season after the Songkran holiday 12-16 April.

Although standard MOP continues to weaken in Indonesia and Malaysia, the Thai MOP market is stable with import prices in the $320-$335 CFR level. The new Indian standard MOP contract is expected to settle in April, which should set a price floor.

Thai Highlands Sustainable Agriculture

Thai Highlands Sustainable Agriculture

Learning from the Royal Project Model

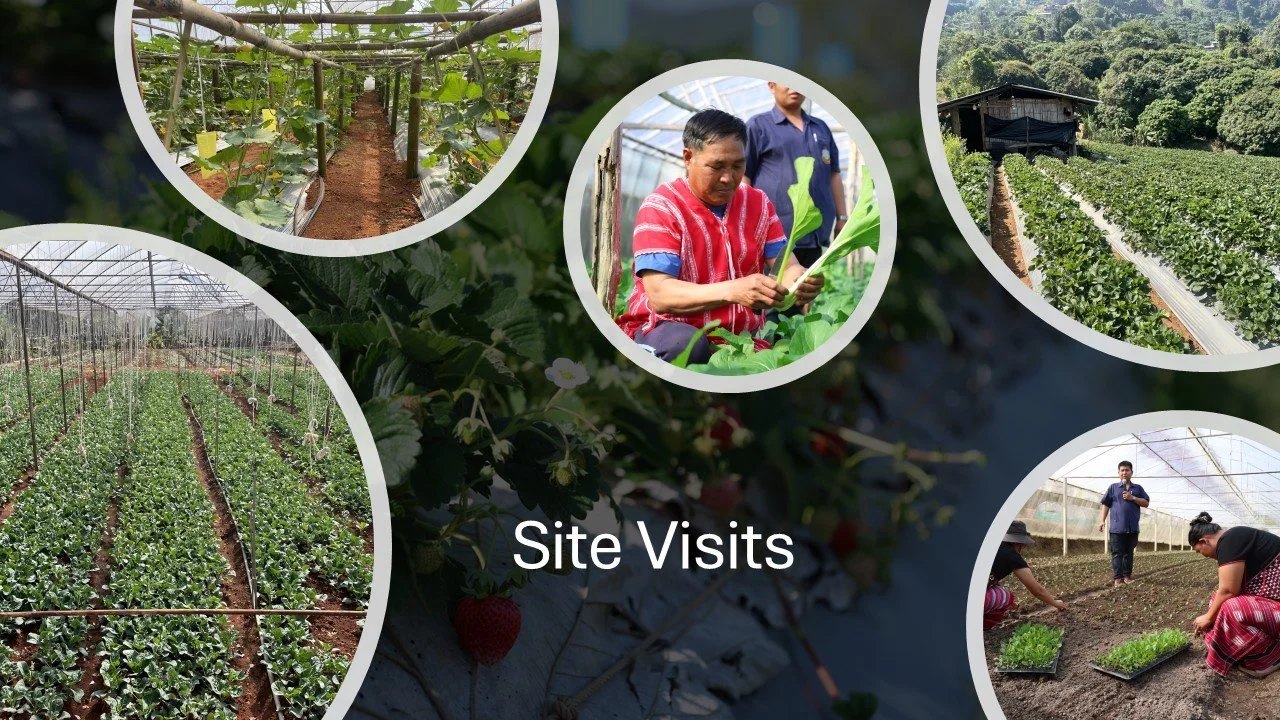

Recently, we had the privilege of attending a five-day workshop on sustainable agriculture practices organized by The Royal Project Foundation Learning Institute, Highland Research and Development Institute (HRDI), and the Thailand International Cooperation Agency (TICA). The workshop focused on the Royal Project Model (RPF Model), initiated by His Majesty King Bhumibol Adulyadej The Great in 1969 to eliminate opium cultivation and improve the lives of highland communities while promoting conservation.

Using the RPF Model, the HRDI has continued the remarkable success of the Royal Project, eliminating opium cultivation, increasing income and community development, and protecting land and water resources. Opium cultivation has been reduced from 17,920 hectares of planted area in 1966 to less than 17 hectares in 2022.

The workshop delved into key practices like optimal crop selection, water and soil management, greenhouse technology, and pest control. These practices are taught in six Northern Thai provinces and through 39 Research and Development Centers.

I was particularly impressed by the regenerative agriculture concepts that small-scale farmers can immediately use in the field.

A BIG thank you to all the organizers of a great workshop. Please explore the HRDI website to learn more about the incredible work they do every day. https://www.hrdi.or.th/en/Home

Q4 Fertilizer Review

Q4 Fertilizer Review

At the close of 2023, prices for Urea, DAP, and MOP are substantially lower than at the start of the year. In the fourth quarter, Urea and MOP prices have stabilized at lower levels. Fertilizer affordability to crop prices are currently favourable for farmers. India’s rice export ban has helped support Thai rice prices.

Container and bulk freight continued their ascent in the 4th quarter due to geopolitical risk. Freights have risen to 18-month highs.

The conflict in the Middle East between Israel and Hamas in the Gaza Strip has created turmoil in the Red Sea. The Houthi rebels have been attacking vessels in the Red Sea and are targeting vessels from Israel as they transit through the Bag al-Mandeb Straight. This could affect MOP vessels from Israel and Jordan transiting to Asia. 12% of all global trade transits through the Red Sea.

The lack of sufficient rainfall due to El Niño is forcing the Panama Canal Authority to reduce the number of vessels by 40% that can transit through the canal. 40% of all U.S. container traffic travels through the Panama Canal. This is affecting global shipping routes to and from North America.

The conflict between Ukraine and Russia continues to affect world freight and insurance markets.

El Niño and depleted water levels in the major dams remain a concern in Thailand.

The Asia regional fertilizer conference was held in Bangkok from 11 - 13 October at the Mandarin Oriental Hotel. The most impactful news affecting the Thai fertilizer industry in the fourth quarter was China’s 9 November decision by the National Development and Reform Commission (NDRC) to immediately suspend all CIQ inspections which effectively halted all exports of Urea, DAP, SOP and compound, finished fertilizers. The move was made to stabilize domestic Chinese prices, discourage speculation, and ensure sufficient levels for domestic supply. The export ban is expected to last through the first quarter of 2024, but details are unclear.

The Thai Baht / US Dollar exchange rate has strengthened in the fourth quarter with speculation that the U.S. Federal Reserve will lower interest rates in 2024. The exchange rate ended the quarter 34.8 – 35.1 Baht / USD range.

UREA

Urea ended the quarter at $358 CFR, down 14% for the quarter and 26% year over year. Local wholesale prices ended the quarter at 13,800 Baht in bulk per metric ton ex-warehouse.

India is producing record amounts of monthly urea reducing import tender demand. In 2023, imports have decreased by approximately 3 million tons.

India announced a tender of 1.0 – 1.5 million tons on 4 January for shipment up to 29 February. With China effectively out of the export market, prices should stabilize in S.E. Asia.

Natural Gas prices have eased since the start of the quarter. Ammonia prices have softened to $525 CFR (from $575 CFR per metric at the end of the 3rd quarter).

Urea prices have stabilized but could again become volatile if there is a disruption in the ammonia or natural gas markets due to geopolitics or if India comes into the market and buys substantial quantities.

DAP

DAP prices rose slightly in the 4th quarter to $620 CFR mostly due to supply tightness in China. Year over year, DAP prices have decreased 14%. Local wholesale prices traded at around 23,100 Baht per metric ton at the end of the quarter.

China’s decision of 9 November to halt exports has caused problems for Thai bulk blenders. Inventories of DAP remain low and may cause production issues in the first quarter. Small quantities of DAP are being sent by train from Kunming, but supply remains sparse. Phosagro (Russia) and Sabic/Ma’aden (Saudi Arabia) are the only other viable options outside of China.

Both India and Pakistan have low DAP inventories. In late October, India reduced the DAP Nutrient Based Subsidy (NBS) by 31%. At current prices, importers will lose $70-$80 per ton creating reluctance among buyers. Many thought this would put pressure on the DAP prices. However, China’s decision to halt phosphate exports has kept the price stable to firm.

The supply of DAP in Thailand continues to remain tight as importers are only buying what they immediately need and have delayed larger purchases until the first quarter of next year and until the decision on China export policy is more clear. Local prices remain elevated. Prices are softening in North and South America but remain stable in Asia.

MOP

Granular MOP prices declined 3% in the 4th quarter to around the $370 CFR level. Prices have been declining since the peak in June 2022 at $1,125 per ton CFR. Most believe the market has stabilized and prices should remain stable through the first half of 2024. Local wholesale prices ended the quarter down 15% to 14,000 Baht ex-warehouse (from 16,400 Baht).

IPL (India) signed a new standard grade MOP contract at $319 CFR with 180 days credit. The Indian MOP subsidy was cut 85% to Rs1,427 per metric ton.

MOP Imports into Thailand from Jan-Oct were down 21% to 539,200 metric tons.

Palm Oil prices in South East Asia have stabilized and fresh fruit bunch prices are healthy at 7 Baht per kg.

Belarus exports have recovered and the price discount from other origins has closed. BPC will export 7 million tons in 2023. Their exports are expected to reach 10-12 million in 2024 largely supported by China.

Yemen’s Houthi rebels have been attacking vessels in the Red Sea. This may cause disruption and a change in routing for Dead Sea Works (Israel) MOP vessels. An Israeli MOP cargo for Thailand loaded at the end of December and is scheduled for a first half January arrival. It is unclear whether

Increased supply of granular MOP from Laos and Belarus has helped stabilize prices in Asia. Sino-KCL (Laos) is expected to commission their third 1 million ton per year production line by the end of the fourth quarter. The current capacity is three million tons per year with a target of five million tons by the end of 2027. The other active MOP producer in Laos, Lao Kaiyuan, currently has a one million-ton capacity (300,000 tons of granular).

Granular MOP prices should remain stable in Thailand going into the first quarter.

Trusted Brands

Chewachem and Rio Tinto Minerals were happy to support the Thai Fertilizer Producer and Trade Association’s (TFPTA) annual golf day. TFPTA plays a key role in working with the government, agricultural universities and the private sector to support Thai agriculture. The tournament raised 500,000 Baht in support of the Agriculture Faculty at Kasetsart University.

For high quality Boron fertilizers -- think 20 Mule Team Borax™. For longer drives, greater accuracy on approaches and superior feel around the greens -- think Titleist.

Welcome

Like a seedling - ready to grow and excited about the future.

Chewa (ชีวา) in Thai means “Life”.

Chewachem was named for the important role of chemical fertilizers in sustaining life through agriculture. As the population continues to grow and arable land declines, maintaining and improving crop yields is extremely important. The role of fertilizers in food production is critical to sustaining our food supply. With approximately 20 million hectares of planted area, Thailand is one of the world’s most important agricultural markets.

Thailand imports over 5 million tons of chemical fertilizers annually. There are 13 essential nutrients for plant growth. Chewachem supplies many of these nutrients to manufacturers and dealers across the country.

We’re happy you chose to learn more about Chewachem. Please drop us a note - we would love to hear from you.

Thanchanok (Air) Suwaprasert, Managing Director