Q2 Fertilizer Summary

KEY HIGHLIGHTS

Geopolitical volatility affecting all areas of the global fertilizer industry.

Israel-Iran conflict. 43.7 million tons of fertilizer and feedstock exports and 20-25% of the World’s oil exports transit through the Strait of Hormuz and the Persian Gulf.

Urea production disruptions in Egypt on a lack of LNG supply. Egypt traditionally exports over 4m tons of urea per year.

EU Tariffs on Russian and Belarussian fertilizers effective 1 Jul. 40-45 Euros per ton in 2025-26 and increasing every year afterwards.

China allows Urea exports from Jun-FH Oct (first exports since June 2023)

China DAP export window opens from June-Sept

Three Indian Urea tenders during the quarter

China/India standard MOP contract settlement at a substantial price increase (23%+) from 2024

Sharp weakness in the U.S. Dollar and continued tariff uncertainty

Ukraine drone strikes drone hit EuroChem’s Nevinnomyssk fertilizer plant, causing production disruptions

7.7 Magnitude earthquake hit Myanmar on 28 March

India and Pakistan conflict over 22 April terrorist attack and 7 May counterattack

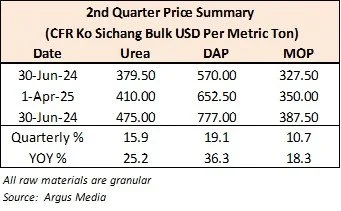

Urea: Prices continued to increase from the 1st quarter, soaring 16%.

DAP: Prices firmed 19% in the quarter on tight supply and healthy demand.

MOP: Prices remain affordable but increased 11% for the quarter

Sulphur / Sulphuric Acid: Prices remained very firm over geopolitical tensions between Israel/Iran. China, India and Morocco will be primarily affected as the main buyers of Sulphur from the region.

Freight Rates: Container shipping rates from China remain elevated with supply chain delays of 2-4 weeks common.

The Thai Baht ended the quarter strong at/around 32.2 Baht/USD.

Volatility Rules the Quarter

Double digit price increases for all raw materials

UREA

Urea ended the quarter up 16% to $475 CFR and up 25% year over year. Local wholesale prices ended the quarter at around 15,500-15,800 Baht per metric ton in bulk ex-warehouse.

The quarter began on a firm note over U.S. tariff uncertainty for Urea producing countries like Algeria (30% tax proposed) and Nigeria (14% tax proposed) and shortages of gas supplies in Egypt. India issued a tender for 1.5m tons on 8 April and bought 885,000 tons at $385 CFR (West Coast) and $398.24 (East Coast). Speculation on China permitting Urea exports and India not securing the full 1.5m tons contributed to market uncertainty.

Thai and SE Asia buying picked up after Songkran, with good rains anticipated for the main season. China officially opened Urea exports from June through 15 October for the first time since June 2023, however, exports to India remained restricted. Healthy demand from India, Ethiopia, Australia and Latin America kept the market stable through May.

On 12 June, India tendered another 1.5m tons. India’s Urea stocks at the end of May were historically low (down 34% from 2024). Geopolitical escalation peaked mid-June, with Israeli and U.S. strikes on Iran, sparking a $100/ton jump in Urea FOB values across several markets. Due to the conflict, only 229k tons were booked on the 12 June India tender with a follow-on tender expected in July.

Urea prices ended the quarter firm. The urea market direction is volatile, but will likely trend according to the next India tender results expected 8 July.

DAP

DAP prices remained elevated in the 2nd quarter. The price of DAP increased 19% in the quarter and 36% year over year to the $775-$780 CFR level. Local wholesale prices increased to 25,800 – 25,900 Baht per metric ton at the end of the quarter.

The big news was China’s decision to open the MAP/DAP export window from June-Sept. Cargoes with CIQ approvals by the end of September are expected to be approved for customs clearance and export. Exports to India, however, were still restricted which helped Thailand secure much needed tons. Demand from Ethiopia, SE Asia and Pakistan was healthy in the 2nd quarter.

SE Asia DAP prices were priced at a discount in the 2nd quarter to India CFR prices, which is unusual because of India’s significant phosphate volume. The Department of Fertilizers in India hoped to maintain a purchase ceiling at $700 CFR, but by the end of the quarter were purchasing at $790-$800 CFR.

Geopolitical tensions continue to present challenges for phosphate exporters who transit the Red Sea and the Suez Canal. Increased freight costs and transit times are affecting most exporters.

The DAP market will remain firm, especially as China is expected to restrict exports after September and other supply options are limited. Affordability and demand destruction are areas of concern.

MOP

Granular MOP prices increased 11% from the end of the 1st quarter and 18% year over year. Local wholesale prices ended the quarter at 13,400-13,800 Baht per metric ton for non-Laos origin and 12,400 per metric ton for Laos MOP. Thai Oil Palm FFB prices remain depressed which is marginally affecting demand.

China agreed to new contracts for standard grade MOP at $346 CFR for the remainder of 2025. India concluded at $349 CFR with 180 days credit. Annual contracts with India and China increased $66 per ton and $73 per ton, respectively, from 2024.

Geopolitical risk from the Israel-Iran conflict has affected MOP export deliveries from Dead Sea Works (Israel) and Arab Potash Corporation (Jordan). Most importers are having difficulty securing all the MOP tons required.

MOP prices will continue firm with little downside due to limited availability, supply chain issues and healthy demand.