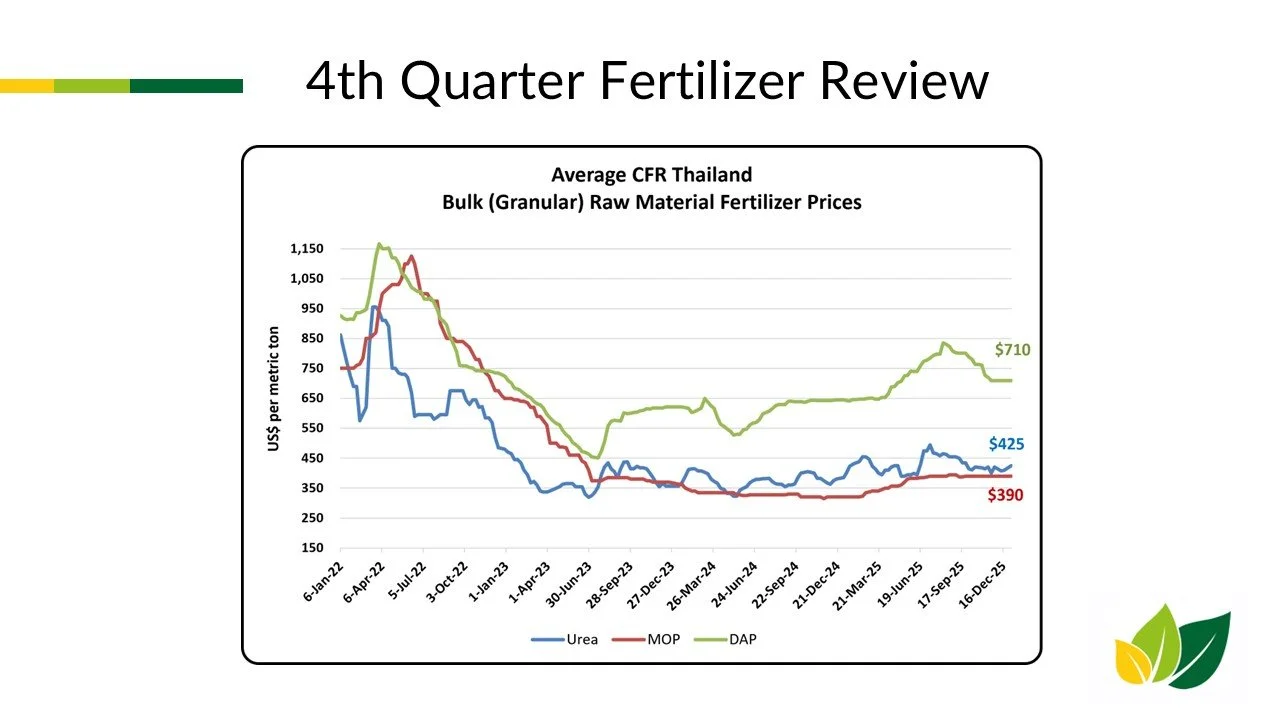

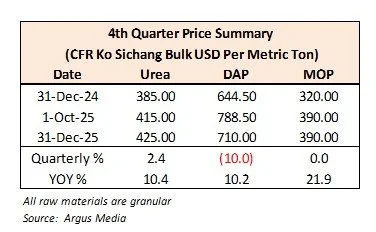

Q4 Fertilizer Summary

Prices trending sideways.

KEY HIGHLIGHTS

• Geopolitical volatility affecting all areas of the global fertilizer industry.

✧ Currency / Political crisis in Iran

✧ Russia-Ukraine conflict

✧ Red Sea freight risks

• China export window for fertilizers is expected to open 1 Aug 2026 subject to Chinese domestic prices and food security policies

• Urea: Uncertainty in the market. India urea tender FH Jan to dictate direction.

• DAP: China halted exports in October. Off-season demand lull in 4th quarter.

• MOP: Stable with good availability.

• Sulphur prices at 17-year highs putting price pressure on DAP and sulphate fertilizers.

• Uncertainty with 1-Jan 2026 implementation of the EU’s Carbon Border Adjustment Mechanism (CBAM)

• The Thai Baht continued firm settling around 31.3 Baht/USD up roughly 10% for the year.

UREA

Urea prices increased 2% to $425 CFR in the 4th quarter and 10% year over year. Local wholesale prices ended the quarter at 13,800 Baht per metric ton in bulk ex-warehouse.

There were two Indian tenders in the quarter. Lowest tender offers were $398.50 CFR in October and $419 CFR in November. A third tender was announced with results expected in the first half of January.

Urea prices are stabilizing as it is the off-season for Southeast Asia. Price direction in the first quarter will be driven by the Indian tender and supply availability in the Middle East.

DAP

DAP prices decreased 10% in the 4th quarter driven mainly by soft demand. However, DAP prices have increased 10% year over year and have traded over $600 FOB since September of 2024. Local wholesale prices remained elevated at 25,200 – 25-400 Baht per metric ton in bulk.

Sulphur prices are at 17-year highs. Russia, one of the world’s largest exporters, banned exports from 4 November until 31 March 2026.

China’s export window officially closed 15 Oct and will re-open in August of 2026. Thailand will likely procure supply from Saudi Arabia, Russia and Morocco. Availability, affordability and demand destruction are current areas of concern. Thai DAP imports in 2025 decreased by 7% from 2024.

MOP

Granular MOP prices were flat in the 4th quarter, but up 22% for the year. Local wholesale prices remained stable at 13,200 – 13,400 Baht per metric ton with ample supply available in the market.

Imports of MOP into Thailand in 2025 were up 18% to 1,034,003 metric tons. MOP prices are stable with very little downside. China and India have both settled their standard grade MOP contract at $346 CFR, providing a relative price floor. China’s halt on NPK exports should help support MOP prices. The widespread availability of MOP in Thailand should keep prices affordable.

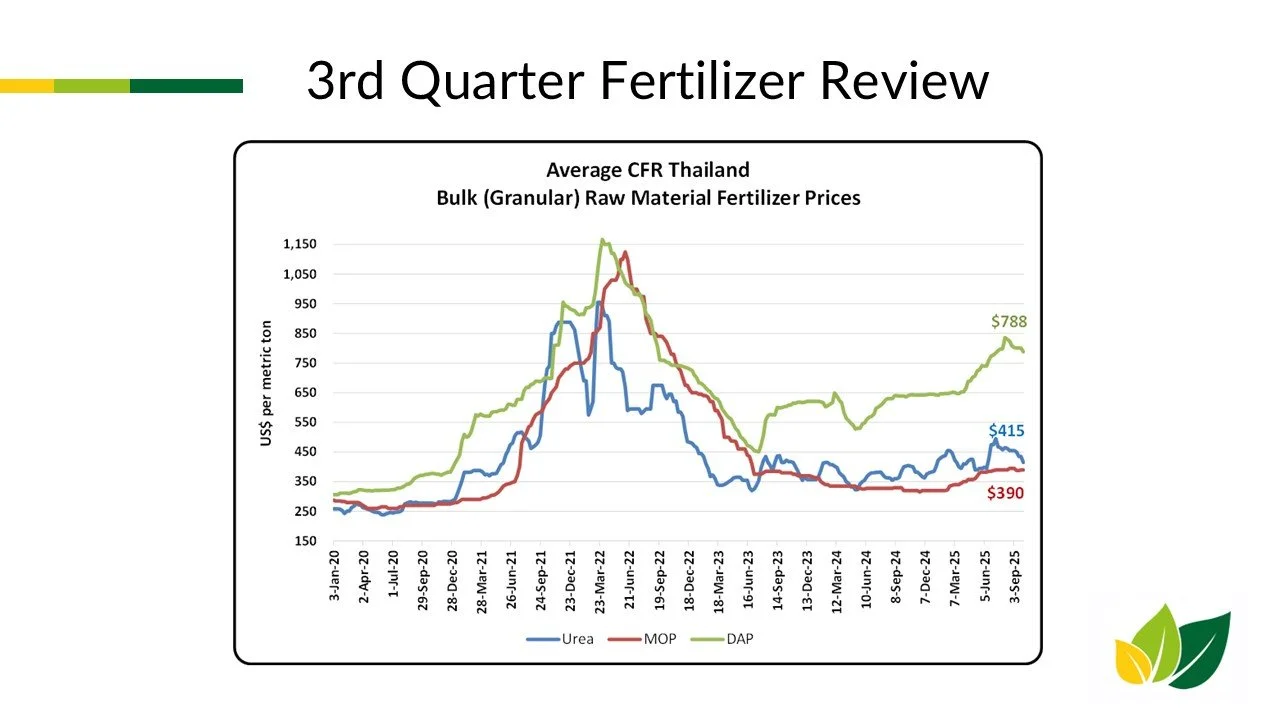

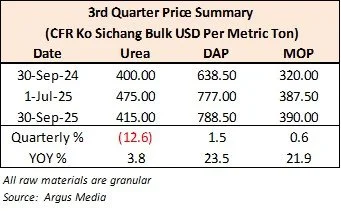

Q3 Fertilizer Summary

Key Highlights

• Geopolitical tensions (Israel–Iran, Russia–Ukraine) continued to affect global fertilizer markets

• EU imposed tariffs on Russian and Belarusian fertilizers (EUR 40–45/ton from July 2025)

• China expected to halt exports of Urea and DAP/MAP on October 15

• Egypt’s LNG shortage disrupted 4M tons/year of Urea production

• Ammonia firmed to $540 CFR Tampa (up from $417)

• Sulphur remained very firm around $360 CFR SE Asia

• Thai Baht stable at 32.2–32.4 Baht/USD

Prices in Search of a Direction

Urea

Urea prices dropped 13% to $415 CFR in Q3 but were still 4% higher year-on-year. Thai wholesale prices held around 15,600 Baht/ton ex-warehouse. India’s three tenders drove global price swings — the July tender closed at an average of $494, August peaked at $531, and September fell to $462–464 CFR. Record offers of 5.56M tons reflected market oversupply and weaker demand. With China supporting India’s latest tender, prices declined another $43. Short-term outlook: weaker prices expected through Q4 with China’s export ban. India the main driver of prices.

DAP

DAP increased 2% in Q3 and 24% year-on-year. Local Thai prices held at 25,800–26,000 Baht/ton. Import prices rose from $735–745 CFR in July to $780–790 in August. Offers above $800 were rejected. India, Bangladesh, and Ethiopia kept demand firm with 700K+ tons in tenders. Near-term weakness expected before stabilizing after China halts exports on October 15.

MOP

Granular MOP prices rose 1% in Q3 and 22% year-on-year. Local prices ended slightly softer at 13,200–13,400 Baht/ton. Higher CPO prices (+13%) and Palm FFB prices supported MOP demand. Thailand imported 701K tons (+22%) from Jan–Jul — Laos 153.9K, Jordan 114.4K, and Belarus 77.8K (down 21%). Overall, MOP remains stable with limited downside. China’s NPK export restrictions should help maintain firm prices.

Q2 Fertilizer Summary

KEY HIGHLIGHTS

Geopolitical volatility affecting all areas of the global fertilizer industry.

Israel-Iran conflict. 43.7 million tons of fertilizer and feedstock exports and 20-25% of the World’s oil exports transit through the Strait of Hormuz and the Persian Gulf.

Urea production disruptions in Egypt on a lack of LNG supply. Egypt traditionally exports over 4m tons of urea per year.

EU Tariffs on Russian and Belarussian fertilizers effective 1 Jul. 40-45 Euros per ton in 2025-26 and increasing every year afterwards.

China allows Urea exports from Jun-FH Oct (first exports since June 2023)

China DAP export window opens from June-Sept

Three Indian Urea tenders during the quarter

China/India standard MOP contract settlement at a substantial price increase (23%+) from 2024

Sharp weakness in the U.S. Dollar and continued tariff uncertainty

Ukraine drone strikes drone hit EuroChem’s Nevinnomyssk fertilizer plant, causing production disruptions

7.7 Magnitude earthquake hit Myanmar on 28 March

India and Pakistan conflict over 22 April terrorist attack and 7 May counterattack

Urea: Prices continued to increase from the 1st quarter, soaring 16%.

DAP: Prices firmed 19% in the quarter on tight supply and healthy demand.

MOP: Prices remain affordable but increased 11% for the quarter

Sulphur / Sulphuric Acid: Prices remained very firm over geopolitical tensions between Israel/Iran. China, India and Morocco will be primarily affected as the main buyers of Sulphur from the region.

Freight Rates: Container shipping rates from China remain elevated with supply chain delays of 2-4 weeks common.

The Thai Baht ended the quarter strong at/around 32.2 Baht/USD.

Volatility Rules the Quarter

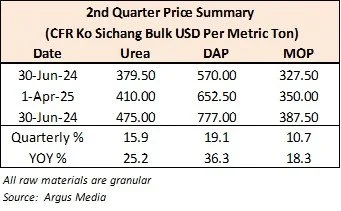

Double digit price increases for all raw materials

UREA

Urea ended the quarter up 16% to $475 CFR and up 25% year over year. Local wholesale prices ended the quarter at around 15,500-15,800 Baht per metric ton in bulk ex-warehouse.

The quarter began on a firm note over U.S. tariff uncertainty for Urea producing countries like Algeria (30% tax proposed) and Nigeria (14% tax proposed) and shortages of gas supplies in Egypt. India issued a tender for 1.5m tons on 8 April and bought 885,000 tons at $385 CFR (West Coast) and $398.24 (East Coast). Speculation on China permitting Urea exports and India not securing the full 1.5m tons contributed to market uncertainty.

Thai and SE Asia buying picked up after Songkran, with good rains anticipated for the main season. China officially opened Urea exports from June through 15 October for the first time since June 2023, however, exports to India remained restricted. Healthy demand from India, Ethiopia, Australia and Latin America kept the market stable through May.

On 12 June, India tendered another 1.5m tons. India’s Urea stocks at the end of May were historically low (down 34% from 2024). Geopolitical escalation peaked mid-June, with Israeli and U.S. strikes on Iran, sparking a $100/ton jump in Urea FOB values across several markets. Due to the conflict, only 229k tons were booked on the 12 June India tender with a follow-on tender expected in July.

Urea prices ended the quarter firm. The urea market direction is volatile, but will likely trend according to the next India tender results expected 8 July.

DAP

DAP prices remained elevated in the 2nd quarter. The price of DAP increased 19% in the quarter and 36% year over year to the $775-$780 CFR level. Local wholesale prices increased to 25,800 – 25,900 Baht per metric ton at the end of the quarter.

The big news was China’s decision to open the MAP/DAP export window from June-Sept. Cargoes with CIQ approvals by the end of September are expected to be approved for customs clearance and export. Exports to India, however, were still restricted which helped Thailand secure much needed tons. Demand from Ethiopia, SE Asia and Pakistan was healthy in the 2nd quarter.

SE Asia DAP prices were priced at a discount in the 2nd quarter to India CFR prices, which is unusual because of India’s significant phosphate volume. The Department of Fertilizers in India hoped to maintain a purchase ceiling at $700 CFR, but by the end of the quarter were purchasing at $790-$800 CFR.

Geopolitical tensions continue to present challenges for phosphate exporters who transit the Red Sea and the Suez Canal. Increased freight costs and transit times are affecting most exporters.

The DAP market will remain firm, especially as China is expected to restrict exports after September and other supply options are limited. Affordability and demand destruction are areas of concern.

MOP

Granular MOP prices increased 11% from the end of the 1st quarter and 18% year over year. Local wholesale prices ended the quarter at 13,400-13,800 Baht per metric ton for non-Laos origin and 12,400 per metric ton for Laos MOP. Thai Oil Palm FFB prices remain depressed which is marginally affecting demand.

China agreed to new contracts for standard grade MOP at $346 CFR for the remainder of 2025. India concluded at $349 CFR with 180 days credit. Annual contracts with India and China increased $66 per ton and $73 per ton, respectively, from 2024.

Geopolitical risk from the Israel-Iran conflict has affected MOP export deliveries from Dead Sea Works (Israel) and Arab Potash Corporation (Jordan). Most importers are having difficulty securing all the MOP tons required.

MOP prices will continue firm with little downside due to limited availability, supply chain issues and healthy demand.

Volatility in the Short Term

A Picture says 1000 Words. Great Infographic. Short-term volatility for sure.

Thailand will be affected. In 2024, fertilizers imported from the Persian Gulf:

• 1.3m tons from Saudi Arabia

• 414k tons from Oman/Iran

• 238k tons from Qatar

• 80k tons from Bahrain

and from the Red Sea:

• 111k tons from Jordan

• 97k tons from Israel

and corresponding ripple effects:

• Higher sulphur and ammonia costs

• Higher freight costs and supply chain disruptions

• Higher prices across product lines and origins

Make it stand out

Whatever it is, the way you tell your story online can make all the difference.

Q1 Fertilizer Review

KEY HIGHLIGHTS

Urea: Prices continued their increase from the fourth quarter in anticipation of large buying from India. Prices peaked in February at $455 CFR before falling in March.

DAP: Tight supply as no exports were approved from China in the first quarter.

MOP: Prices remain affordable, but all suppliers are increasing prices for the second quarter.

Sulphur: The price increased over 150% in the quarter and over 700% year-over-year, partially because of high DAP/MAP prices. This impacts all fertilizers using sulphuric acid.

U.S. Dollar: Concerns across commodity markets about tariffs proposed by the new administration and when they will become effective.

Irrigation Water: water volumes are ahead of 2024 levels and remain healthy according to the Thai Royal Irrigation Department

Freight Rates: Container shipping costs from China eased from the 4th quarter but remain elevated ($38-$40 pmt from N. China).

Raw materials remain firm. Global uncertainty continues.

UREA

Urea ended the quarter up 2.6% to $395 CFR. Prices were as high as $455 CFR at the end of February. Local wholesale prices ended the quarter at around 15,000 Baht per metric ton in bulk ex-warehouse.

The quarter started strong in anticipation of a new Indian tender for 1.5m tons for loading by 5 March. The winning offers were $427 pmt CFR east coast and $422 pmt CFR west coast, but only 500k tons were accepted. Production from Iran was also severely reduced on limited gas supplies for most of the quarter. India’s inventories remain seasonally low. Most anticipated another tender in February, but when it did not materialize until the end of March, prices fell.

On 26 March, India announced a tender for 1.5m tons with results to be announced on 8 April for loading by 12 June. The results should set the mood for the 2nd quarter. Buying is expected to pick up in April in Thailand after Songkran ahead of the main application season. Sabic loaded four urea vessels and Bahrain and Petronas each loaded one urea vessel for Thailand at mid/end of March. China continues to be absent from the urea export market. Pending the Indian tender results, supply should be tight.

The urea market will most likely trend sideways for the second quarter

DAP

DAP prices remained elevated in the 1st quarter. The price of DAP increased 1.2% in the quarter to the $650-$655 CFR level. Local wholesale prices surged to 25,200 – 25,400 Baht per metric ton at the end of the quarter.

There was steady DAP demand from India and Ethiopia and much of the demand was filled by Morocco, Jordan, Saudi Arabia and Russia. Most of the Thai demand is being filled by Phosagro (Russia) and SABIC/Ma’aden (Saudi Arabia).

The story continues to be the lack of supply from China due to the export ban on MAP/DAP. The Phosphate Association is expected to meet 23-25 April to decide when to export policy. Most expect DAP exports will resume at the end of May after China’s main season is finished.

The EU has proposed additional tariffs on Russian MAP, DAP, NPK, NP and NK of 40 Euros per ton from 1 July 2025 on top of the 6.5% current import duty and raising them each year onwards. It is not clear if the resolution will be approved.

The DAP market will remain firm until China resumes exports. Demand is healthy.

MOP

Granular MOP prices have bottomed in January and have started to increase with healthy demand from Brazil. Prices at the end of the first quarter were up 7.8% to around the $340-$345 CFR level. Local wholesale prices ended the quarter at 12,300 Baht per metric ton for non-Laos origin and 11,800 per metric ton for Laos MOP.

The international banking / SWIFT sanctions against Belarus and Russia, have caused several Thai buyers to switch to Jordanian MOP for ease of import. There are concerns around the threat of U.S. tariffs and the uncertainty around the treatment of fertilizers. Canada supplies over 12 million tons or 85% of U.S. potash and 25% of U.S. nitrogen fertilizers. There currently is a pause on most new tariffs for a 90-day period though the policy as well as the exempt items are not yet clear.

Suppliers are actively trying to increase prices, and the trend will continue in the 2nd quarter. Both Russia and Belarus are cutting production and Nutrien is fully committed for the first half of 2025.

Standard grade MOP contracts for China and India will most likely be settled in April and will further tighten supply once agreed. MOP prices will continue firm with little downside.

#fertilizer

Q4 Fertilizer Review

KEY HIGHLIGHTS

• Urea: Prices increased sharply at the end of the quarter and are expected to remain firm into the new year.

• DAP: Tight supply from China has kept prices elevated, driven by an export ban from 1 Dec 2024, which is expected to continue through Q1 2025.

• MOP: Prices remain stable and affordable relative to Nitrogen and Phosphate. Supply remains ample and prices are stable to firm with little downside risk.

• U.S. Dollar: Strengthened following Donald Trump’s election victory. There are concerns in the commodity markets about potential tariffs under the new administration.

• Natural Gas: Dutch TTF natural gas prices ended the year at around $14.50 MMBtu, the highest level in 2024, but in line with historical averages.

• Heavy rains and flooding in Thailand curtailed demand in the 4th quarter.

• Freight Rates: Container shipping costs from China remained elevated in the fourth quarter ($45-$55 pmt from N. China).

• Commodity Prices:

- Palm oil rose 18% to approximately $1,000 USD/ton

- Sunflower and rapeseed oil prices significantly increased

- Rubber prices surged 25% to $1.90 per kg

DAP prices remain at a historically wide premium to Urea and MOP

UREA

Urea ended the quarter down 4% at the $385 CFR level, but up 8% year over year. Local wholesale prices ended the quarter at 13,500-13,700 Baht per metric ton in bulk ex-warehouse.

There were three much anticipated Indian tenders during the quarter which supported urea prices. West Coast India ($364.50, $362, $369.75 CFR) and East Coast ($389 CFR). India’s inventories remain seasonally low because of strong demand and good rains. Additional Urea buying tenders from India (19 Dec, 1.5m tons) and Ethiopia (23 Dec, 821,000 tons) helped support prices at the end of the quarter.

The 4th quarter is typically slow for spot buyers of urea in Thailand. China continues to be absent from the urea export market. Gas supply issues limited exports from Iran. Regular buying in SE Asia should resume in January.

DAP

DAP prices remained stable but elevated in the 4th quarter. The price of DAP increased 4% year over year to around the $645 CFR level. Local wholesale prices traded around 22,500-23,000 Baht per metric ton at the end of the quarter and are anticipated to increase further on limited supply.

In 2024, DAP traded at a historically wide margin to Urea prices. Taking out the supply disruptions from Covid-19 and the start of the Russian/Ukraine conflict, DAP prices are trading 45% above their adjusted historical average ($426 FOB).

There was steady DAP demand from India and Ethiopia. Most of the Indian demand was filled by OCP and Ma’aden as China limited exports to India.

Hurricane Helene and Milton significantly impacted phosphate production from Mosaic and Nutrien in Florida. Additionally, the Port of Tampa, responsible for 40% of U.S. phosphate fertilizer exports, faced closures which further tightened the phosphate market.

On 1 Dec, China announced a halt on Customs inspections (CIQ) for MAP/DAP. The export ban is expected to last through the first quarter of 2025. Even CIQ approved shipments in November were not permitted to clear customs. At least two CIQ approved cargoes destined for Thailand were cancelled. This will put further pressure on local pricing in the 1st quarter. NPS and NPK shipments are still approved for export.

There is not much upside in the DAP market, but supply issues will keep the market firm.

MOP

Granular MOP prices were mostly stable around the $315-$320 CFR level. MOP prices were down 12% in 2024. Local wholesale prices ended the quarter at 11,900 Baht per metric ton for non-Laos origin and 11,200 per metric ton or Laos MOP.

Thailand imported 830,992 tons of MOP, up 24%, from Jan-Nov. Canada, Laos and Belarus together accounted for roughly 75% market share.

Labor disputes in key Canadian ports were resolved in November. Vancouver is Canada's busiest port and facilitates exports of potash for Southeast Asia.

Belarussian Potash Corporation (BPC) has hinted at decreasing production to increase MOP prices. BPC is operating at 90% capacity and is fully recovered from the initial shocks of losing the port at Klaipeda and the fallout from international sanctions. Thailand imported 147,000 tons from BPC from Jan-Sep. Uralkali and Eurochem MOP export volumes have also fully recovered.

China standard grade MOP contracts ($270 - $273 CFR) and India ($283 CFR with 180 days credit) are expected to increase next year. MOP prices should remain firm with very little downside.

Q3 Fertilizer Review

DAP prices remain firm and uncorrelated with Urea

and MOP price declines

Urea prices were stable ending the quarter up 1.4% on a bounce from the latest Indian tender.

DAP remained firm increasing 11% for the quarter and 35% year over year on limited supply.

MOP drifted weaker and is forming a bottom.

The Thai Government’s 29.5 billion Baht rice program was put on hold and will be studied further before implementation.

Thai Baht strengthened 11% from 36.8 to 32.8 THB/USD in the 3rd quarter. This will help reduce import prices in the fourth quarter.

The flooding in Chiang Rai, Lampang and Phitsanulok in the North; Nong Khai and Nakhon Phanom in the Northeast; and Ayutthaya in the Central Plain has curtailed fertilizer demand.

The conflict in the Middle East and Ukraine continues to add uncertainty to the supply chain.

Global container freight rates have eased a bit from the second quarter and bulk freight rates have been relatively stable,

China continued to restrict Urea exports and did not export in the 3rd quarter.

Natural Gas disruptions in Egypt have stabilized from the 2nd quarter.

Agricultural commodities posted a strong recovery from July and August weakness. Palm Oil prices are at roughly $950 USD/ton, a level not seen since April.

The regional Asian fertilizer conference is being held 8-10 October in Hong Kong

UREA

Urea ended the quarter around the $385 CFR level up 1.4% for the quarter and down 2.5% year over year. Local wholesale prices ended the quarter at 12,900-13,100 Baht per metric ton in bulk ex-warehouse.

Urea prices drifted lower in July and August on lackluster demand as the market waited for another Indian tender. On 29 August, NLF tendered for 1.13m tons of urea for shipment ending October. Winning offers were $340 CFR West Coast and $349.88 East Coast representing an average decline of $14 per ton from the tender in July.

A subsequent tender was issued 19 September with shipments by 20th November. Price and quantities will be announced on 3 October and could set the price direction in the fourth quarter. India’s expected demand is 2-2.5m tons as inventories are seasonally low and good rains in the monsoon season have kept demand firm.

Thailand urea imports from Malaysia were down 39% on increased supply from Brunei, Indonesia and Oman. China did not export urea in the 3rd quarter instead keeping for domestic consumption and is unlikely to export in the 4th quarter.

DAP

DAP prices increased in the 2nd quarter 11% to $635-640 CFR. Year over year, DAP prices have increased 35%. Local wholesale prices traded around 22,500-23,000 Baht per metric ton at the end of the quarter.

DAP began the quarter at $575 CFR and continued firm on tight supply and limited demand from India. India bought at $550 CFR in first half July and ended the quarter buying in the $630’s CFR level. India delayed purchases in the hopes of price declines as the current subsidy makes buying at these levels unprofitable for importers. Production of DAP (down 15%), import (48%) and sales (11%) were all down in the second quarter respectively. India, Pakistan and Bangladesh eventually were forced to buy at higher price levels as their inventories drew down.

CIQ inspections in China are now taking up to 4 weeks for export approval. DAP prices are expected to remain stable to firm even as demand is typically weak in the fourth quarter in SE Asia.

MOP

Granular MOP prices were mostly stable around the $320-$330 CFR level. Year over year, MOP prices were down 13%. Local wholesale prices ended the quarter at 12,100 – 12,300 Baht per metric ton down about 800 Baht per ton for the quarter. ICL increased their standard grade contract price with an India importer $6 pmt to $285 CFR. This may indicate a market bottom.

Uralkali appears set to enter the Thai market directly and sell both wholesale and retail in their brand. Along with MOP from Laos, this will put further pressure on retail MOP prices.

There is still a large disconnect between SOP and MOP prices. With SOP exports restricted from China, supply of granular is very tight in S.E. Asia. SOP has come down $20-30, but still trades around $650 - $660 CFR from Vietnam/Taiwan.

MOP prices should remain stable as dealers try to maintain their current prices and the CPO price remains strong.

A fun look at inflation

Are today’s inflation-adjusted prices affordable?

Tickets to the 1975 World Series Game – Game 6: Price $7.50

This game is always mentioned as one of the greatest games in World Series History.

Four-Day Pass to the 1985 Masters: Price $75

Bernhard Langer won and all Top 10 finishers are in the PGA Hall of Fame.

Tickets to the 1991 World Series: Price: $45.

Most Braves fans prefer to remember 1995.

Standard Grade Muriate of Potash (MOP), FOB Vancouver in USD.

February Price Levels:

1988 ($88pmt)

1998 ($125pmt)

2008 ($375pmt)

2018 ($230pmt)

2024 ($240pmt)

Source: Argus Media.

Excluding the extreme events in 2008, Covid-19 and the geopolitical disruptions in 2021-2022, MOP has increased about 3.5% per year, generally in line with inflation. If all the other events above had a similar 3.5% inflationary increase, prices might still be very reasonable for the average fan:

A World Series ticket at Fenway Park today would cost approximately : $52

A Four-Day Pass to the 2024 Masters : $287

A World Series ticket to see the Braves win in 2024 : $140

Conclusion: Potash at $240 seems quite affordable.