Q3 Fertilizer Summary

Key Highlights

• Geopolitical tensions (Israel–Iran, Russia–Ukraine) continued to affect global fertilizer markets

• EU imposed tariffs on Russian and Belarusian fertilizers (EUR 40–45/ton from July 2025)

• China expected to halt exports of Urea and DAP/MAP on October 15

• Egypt’s LNG shortage disrupted 4M tons/year of Urea production

• Ammonia firmed to $540 CFR Tampa (up from $417)

• Sulphur remained very firm around $360 CFR SE Asia

• Thai Baht stable at 32.2–32.4 Baht/USD

Prices in Search of a Direction

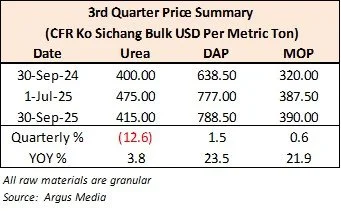

Urea

Urea prices dropped 13% to $415 CFR in Q3 but were still 4% higher year-on-year. Thai wholesale prices held around 15,600 Baht/ton ex-warehouse. India’s three tenders drove global price swings — the July tender closed at an average of $494, August peaked at $531, and September fell to $462–464 CFR. Record offers of 5.56M tons reflected market oversupply and weaker demand. With China supporting India’s latest tender, prices declined another $43. Short-term outlook: weaker prices expected through Q4 with China’s export ban. India the main driver of prices.

DAP

DAP increased 2% in Q3 and 24% year-on-year. Local Thai prices held at 25,800–26,000 Baht/ton. Import prices rose from $735–745 CFR in July to $780–790 in August. Offers above $800 were rejected. India, Bangladesh, and Ethiopia kept demand firm with 700K+ tons in tenders. Near-term weakness expected before stabilizing after China halts exports on October 15.

MOP

Granular MOP prices rose 1% in Q3 and 22% year-on-year. Local prices ended slightly softer at 13,200–13,400 Baht/ton. Higher CPO prices (+13%) and Palm FFB prices supported MOP demand. Thailand imported 701K tons (+22%) from Jan–Jul — Laos 153.9K, Jordan 114.4K, and Belarus 77.8K (down 21%). Overall, MOP remains stable with limited downside. China’s NPK export restrictions should help maintain firm prices.