Q4 Fertilizer Summary

Prices trending sideways.

KEY HIGHLIGHTS

• Geopolitical volatility affecting all areas of the global fertilizer industry.

✧ Currency / Political crisis in Iran

✧ Russia-Ukraine conflict

✧ Red Sea freight risks

• China export window for fertilizers is expected to open 1 Aug 2026 subject to Chinese domestic prices and food security policies

• Urea: Uncertainty in the market. India urea tender FH Jan to dictate direction.

• DAP: China halted exports in October. Off-season demand lull in 4th quarter.

• MOP: Stable with good availability.

• Sulphur prices at 17-year highs putting price pressure on DAP and sulphate fertilizers.

• Uncertainty with 1-Jan 2026 implementation of the EU’s Carbon Border Adjustment Mechanism (CBAM)

• The Thai Baht continued firm settling around 31.3 Baht/USD up roughly 10% for the year.

UREA

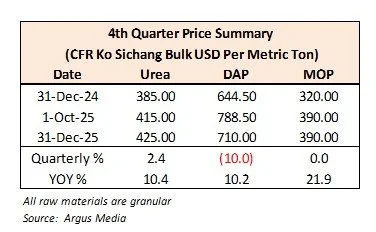

Urea prices increased 2% to $425 CFR in the 4th quarter and 10% year over year. Local wholesale prices ended the quarter at 13,800 Baht per metric ton in bulk ex-warehouse.

There were two Indian tenders in the quarter. Lowest tender offers were $398.50 CFR in October and $419 CFR in November. A third tender was announced with results expected in the first half of January.

Urea prices are stabilizing as it is the off-season for Southeast Asia. Price direction in the first quarter will be driven by the Indian tender and supply availability in the Middle East.

DAP

DAP prices decreased 10% in the 4th quarter driven mainly by soft demand. However, DAP prices have increased 10% year over year and have traded over $600 FOB since September of 2024. Local wholesale prices remained elevated at 25,200 – 25-400 Baht per metric ton in bulk.

Sulphur prices are at 17-year highs. Russia, one of the world’s largest exporters, banned exports from 4 November until 31 March 2026.

China’s export window officially closed 15 Oct and will re-open in August of 2026. Thailand will likely procure supply from Saudi Arabia, Russia and Morocco. Availability, affordability and demand destruction are current areas of concern. Thai DAP imports in 2025 decreased by 7% from 2024.

MOP

Granular MOP prices were flat in the 4th quarter, but up 22% for the year. Local wholesale prices remained stable at 13,200 – 13,400 Baht per metric ton with ample supply available in the market.

Imports of MOP into Thailand in 2025 were up 18% to 1,034,003 metric tons. MOP prices are stable with very little downside. China and India have both settled their standard grade MOP contract at $346 CFR, providing a relative price floor. China’s halt on NPK exports should help support MOP prices. The widespread availability of MOP in Thailand should keep prices affordable.